- Our templates

-

-

-

- Your access to over 230 smart templates

-

-

-

-

-

For the optimal preparation of sustainable business relationships

For secure and successful relationships with customers and suppliers

Ensure compliance of your web footprint with privacy regulations

Keep a record of transactions and deals in shares

Everything about loans and securities

Industry-standard for the IT industry exclusively on Approovd

Up-to-date and secure templates for a wide range of HR matters

Organize and document your shareholders' meetings

Document the elections and decisions of your board of directors

The most important documents for construction and management of real estate

For the management of limited liability companies

Ideal to get to know our platform in a non-binding way

-

-

-

- Pricing

- Support

- Sign in

- Deutsch

- Français

Which Possibilities are there to Secure a Loan?

- February 4, 2022

- Camille Auberson

How do you protect yourself from the credit risk of the person to whom you have lent money?

In the following article, we will inform you about the various ways to secure a loan.

We will guide you through the various means of securing, show you what needs to be taken into account and then provide you with the corresponding templates.

Why Secure a Loan?

Securities or “collaterals” serve to protect the lender. In practice, it is assets or the guarantee of a third party (surety) that the lender accepts as security for the loan. If the borrower is unable to fulfill their obligation under the loan agreement, the lender can use the security to cover its loss.

The provision of security may be regulated either in the loan agreement itself or in a separate agreement. In case of a separate agreement, the latter becomes a part of the loan agreement. In the case of a loan agreement with security, the loan amount is generally transferred to the borrower only after the legally valid provision of the security.

What Possibilites are there to Secure a Loan?

1.

The Surety

In the case of a surety, a third party is liable for the repayment of the loan in addition to the borrower. If the borrower becomes insolvent and is therefore unable to meet their interest payment and/or repayment obligation, this can be claimed from the guarantor. The guarantor can be either a legal entity (company) or a private person. If the guarantor is a private person, the surety generally requires public certification. However, this can be waived if the surety does not exceed the amount of CHF 2,000 and the guarantor enters the maximum liability amount in (hand)writing in the agreement and signs it.

2.

The Assignement of Claims

In the case of an agreement of the assignment of claims, the borrower assigns claims to the lender. It is customary for all existing and future claims to be assigned. However, the loan (or assignment) agreement may also provide that only certain claims are to be assigned.

It must be further clarified whether the borrower is liable either only for the existence of the claims or, in addition, also for the correct payment by the debtor of the claim. Another important point, both from a commercial and a legal point of view, is the information to be given to the “assigned” debtors: Is the lender allowed to inform them immediately about the assignment or only from the time when they intend to enforce the assigned claims?

3.

The Security Transfer Agreement

Under the security transfer agreement, the borrower transfers ownership of certain assets to the lender, whereas the borrower remains in possession of the assets. Here, it may be relevant that the borrower takes out an insurance against customary risks for the transferred assets. Since this security modality may disadvantage the borrower’s other creditors in the event of bankruptcy, the parties must have a good reason for its use. This is the case, for example, if the borrower is to continue using the items assigned as security as part of its business operations.

4.

The Pledge Agreement

In a pledge agreement, the borrower pledges certain assets and transfers possession to the lender. Possible assets include securities (e.g. a share certificate) or valuables (e.g. a painting). If the borrower is unable to meet their obligations to pay interest or the principal, the lender may recover from the proceeds of the sale of the pledged items.

If the pledged asset is a security, it should also be clarified who exercises the associated rights and obligations (voting rights, subscription rights, dividends etc.) and how this should be done. In practice it is often the borrower who will retain these rights, unless an event of defaults occurs.

Templates to Secure a Loan

So that you can devote more time to your core business, we have already prepared the most important templates for you. All you have to do is fill them out and the tedious preparation work is done. These templates include:

Securing a Loan with Approovd is Easy

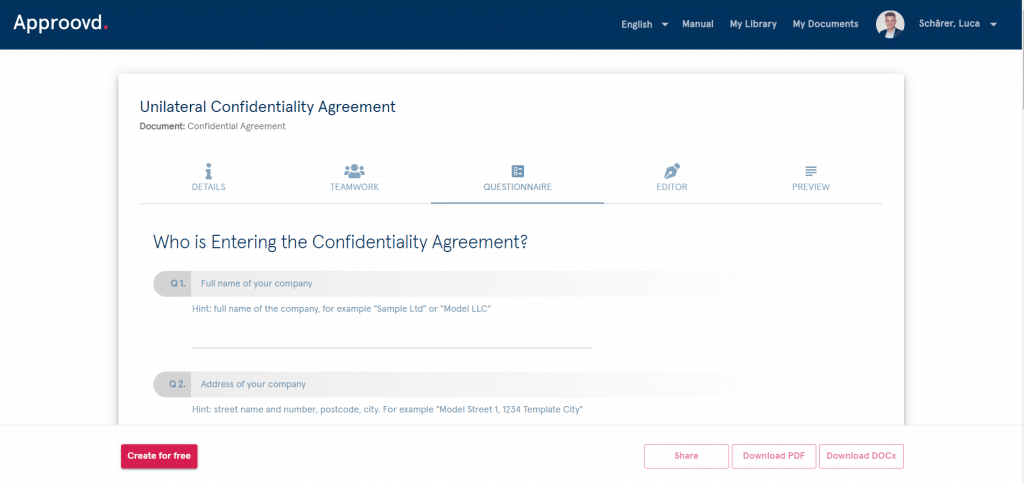

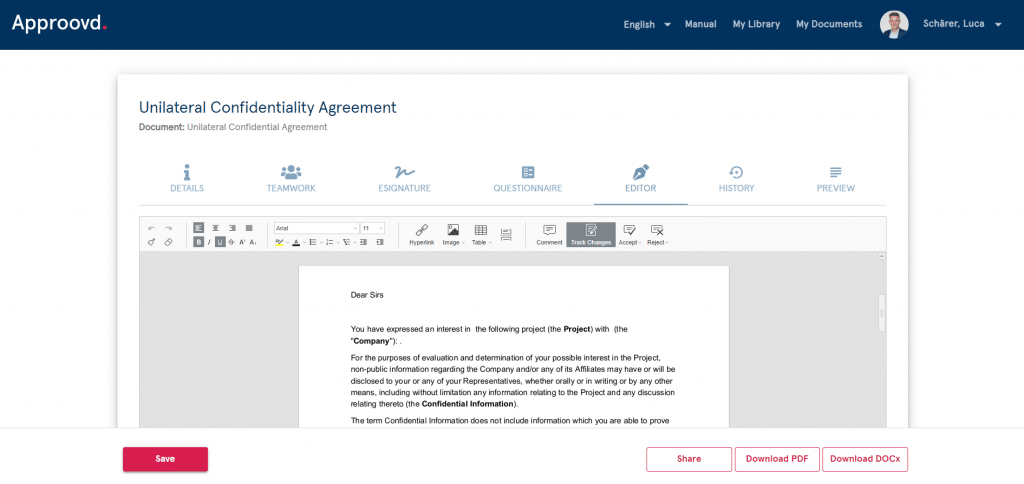

Contract creation with Approovd is not only fast (8 minutes per document on average), but also particularly easy. You don’t need any legal knowledge or anything to install.

1.

You answer between 7 and 32 questions

2.

You download your finished legal document

If you are not sure if Approovd is the right tool for you to secure you loan, you can try it with a selection of free documents and see if it fits your needs.

Camille Auberson

Chief Legal Officer

Approovd

The legal translation machine: Camille has gained extensive experience as a transaction lawyer at Homburger, one of Switzerland’s leading business law firm. There he specialized in mergers and acquisitions, capital market as well as corporate law. The increasing need and untapped potential for digitization in the market for legal services convinced him to join Approovd as an early founder. He also acts as the chairman of the real estate company Nordmann Fribourg Holding SA.